The problems might show up right away or months later. Some dealers may hide a car’s problems or lie about them.

Most used cars are sold “AS IS.” This means there is no guarantee the car is in good condition, and there is no return policy. If the car needs work, YOU pay for the repairs.

The dealer might tell you the car is a “good car” or they’ll “stand behind it.” If the contract says, “AS IS,” the promises mean nothing.

Most used cars are bought in installments, meaning you make monthly payments until the car loan is paid off. You still owe the car payment, even if the car breaks down.

What if you buy the car, drive it off the lot, and it breaks down within hours? You usually cannot just let the car go back to the dealer. You may end up paying for a broken car.

To get your car back from the dealer, most dealers will require you to pay off the whole car note, not just your late or missed payments. If you can’t pay off the amount demanded by the dealer, the dealer can sell your car at auction. Most of the time the car sells for less than the rest of the note. You are responsible for paying the deficiency.

What if you decide that you don’t like the car? What if you lose your job and cannot pay? What if the car breaks down?

You cannot return the car to the dealer and get your money back. Giving the car back to the dealer is called voluntary repossession. If you give up the car, the dealer can sell your car at an auction. Most of the time the car sells for less than the rest of your car note. You must pay the difference between your car note and the amount that the car sells for at the auction. This difference is called a deficiency.

What if you lose your job and miss a payment? What if you make your payment late?

In most car contracts you agree that if you miss a payment or make a late payment, then the dealer can take your car. This is called repossession. The dealer can do this without telling you ahead of time.

1. Know what you need and what you can afford.

Think about what you need in a car and how much you can pay each month before going to the car lot.

2. Be patient.

Don’t get in a hurry. Take your time and go to different car lots.

3. Take it for a test drive.

Drive the car at different speeds for several miles.

4. Take it to a mechanic.

Have a mechanic you trust look at the car and test drive it.

5. Ask for a car history report.

Ask the dealer for the car history report, or write down the car’s VIN and run a report yourself.

6. Do not be fooled by looks.

Don’t get fooled by how good a car looks. What counts is how the car runs.

7. You’ll have to make repairs.

Cars wear out and need regular maintenance. You’ll have to spend money on maintenance and repairs. Don’t spend every dollar you have on a car note.

8. Don’t buy the optional warranty.

Used car warranties sold by a dealer usually cost more than they’ll ever pay back.

9. Read before you sign.

When you sign your name, you are saying you understand and agree. If there is something you don’t agree with, change the contract or walk away. Never sign your name to a paper you haven’t read.

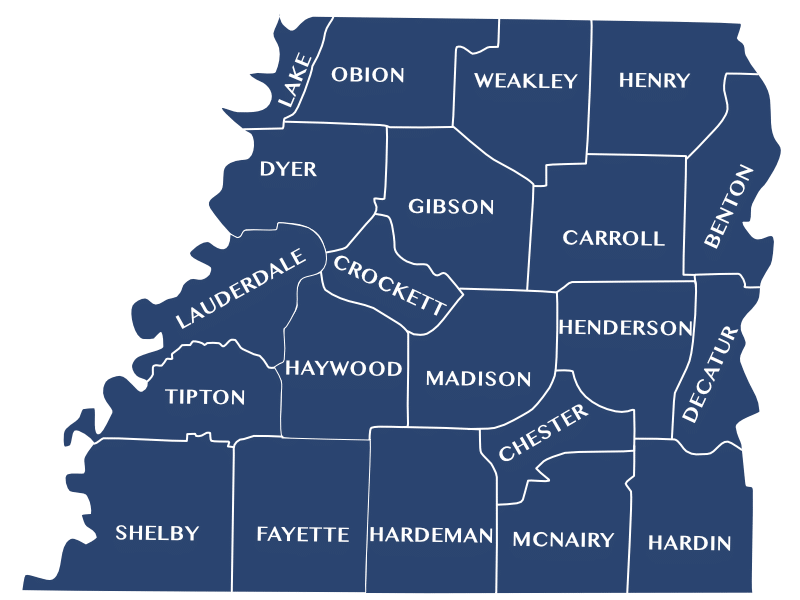

West Tennessee Legal Services

www.wtls.org

Toll Free: 1-800-372-8346 ext. 1250

Fax: 731-423-2600

Email: wtls@wtls.org

To download a copy of this brochure, please click here.

"*" indicates required fields