Repossession is when a creditor (the bank, car dealer, or loan company) takes your car or other item that you used as security (collateral) for a loan. Repossession usually happens when you get behind on payments.

It depends on your contract, or the papers that you signed when you got the car or took out the loan.

Most contracts say that repossession can happen when you are in default, or do not follow the contract. Usually, you are in default if you do not make your full payment on time. Some contracts may give you extra time to make your payments (grace period).

What if you don’t have insurance? Most contracts say that you are in default if you do not have insurance or let your insurance lapse.

What if you move? Some contracts say that you are in default if you do not tell the bank or car dealer your new address. If you move, give the bank or car dealer your new address right away.

The bank or car dealer can repossess the car so long as they don’t breach the peace. They do not have to tell you when or where they will repossess. They usually hire a repo agent to take the car.

They can repossess:

They cannot:

If you think a repo agent or creditor has breached the peace while repossessing, talk to a lawyer right away.

The bank or car dealer may work with you. They may let you catch up your payments and pay the repossession fee, and then return the car to you.

What if the creditor won’t work with you? The creditor may accelerate your loan, or tell you that you have to pay the entire loan to get the car back. The creditor can do this if it says so in your contract.

What if you can’t pay to get back the car? Then, the creditor may sell the car. Before selling the car, the creditor must send you a letter telling you when and how the car will be sold. The letter will also tell you that you can pay the entire loan to get the car back. If you cannot pay the loan, the creditor will sell the car after the date in the letter.

The bank or car dealer may send you a letter telling you how much the car sold for. The letter may say that you still owe money for the car. This is called a deficiency. A deficiency is the difference between what you owed on the car when it was repossessed and what it was purchased for at the sale. The bank or car dealer could sue you for a deficiency.

If you let the car go back to the dealer or the bank, it is called a voluntary repossession. Letting the car go back will save you repossession fees. BUT it is still a repossession. The bank or car dealer can sue you for the deficiency. Talk to a lawyer before you take a car back to the dealer.

You may have a legal claim against the bank or car dealer if they did not send you a letter telling you when the car would be sold and a letter telling you how much you owed after the sale. If you did not get these letters, see a lawyer right away.

File a paper with the court called a Claim of Exempt Property. This will protect your personal belongings, cars, and bank accounts. You do not need a lawyer. File it within 10 days of the court date. Find out more from our booklet, Have you been Sued?

Maybe. Garnishing means taking money out of your paycheck before you are paid.

Do you get $217.50 a week or less after taxes are taken out? If so, then the creditor cannot take anything from your paycheck.

What if you get more than $217.50 per week? Then, 10 days after the court date, the creditor may garnish your paycheck. You can stop a garnishment by making a payment agreement with the creditor, or you can file a Slow Pay Motion with the Court. Find out more from our booklet, How to Keep your Paycheck from Being Garnished.

Is your Social Security or SSI put on a benefits card or mailed to you each month in a check? Then, the creditor cannot take it.

Then you need to file a paper with the Court Clerk to protect your money. Within 10 days after the court date, file a Claim of Exempt Property. Be sure to list your bank account on it. Find out more from our booklet, Have you been Sued?

Yes, but you only have 10 days from the court date to appeal. The 10 days includes weekends and holidays. You may have to pay an appeal bond.

Are your income and assets very low? Then, you may be able to file a pauper’s oath. If you do, you will not have to pay the appeal bond. The Court Clerk can tell you about the pauper’s oath.

The case goes to a higher court. It gets treated like a new case. There is usually a time limit to set a date for a hearing. Most people need a lawyer for this.

What if you lose the appeal? You will owe more court costs and may also owe lawyer fees. Usually Legal Services only does appeals if we took the case before the appeal.

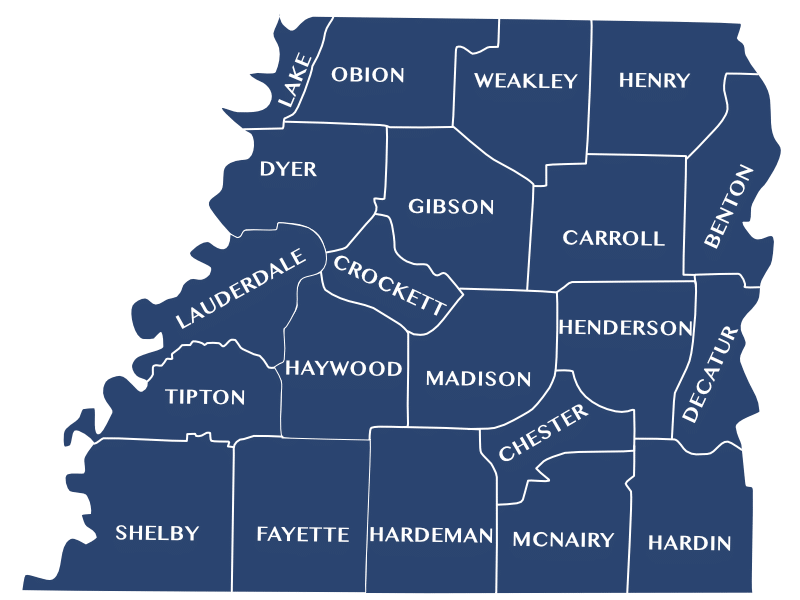

West Tennessee Legal Services

www.wtls.org

Toll Free: 1-800-372-8346 ext. 1250

Fax: 731-423-2600

Email: wtls@wtls.org

To download a copy of this brochure, please click here.

"*" indicates required fields